Welcome to Login

微信登錄

打開手機微信,掃描二維碼

掃描成功

請勿刷新本頁面,按手機提示操作

中科曙光不會以任何理由要求您轉賬匯款,謹防詐騙

您的微信還未注冊

中科曙光不會以任何理由要求您轉賬匯款,謹防詐騙

您可以同時關注中科曙光微信公眾號

使用微信掃一掃即可登錄! 查閱資料更方便、 快捷!

您已經注冊賬號和

關注微信公眾號

2025年1月

服務熱線:400-810-0466

Successful Case

1.1.1 Project background

“Network receipt” is a kind of receipt management model to conduct electrical management of receipt information and receipt business procedure, which uses the data centralized model by tax authorities and is based on network. Through this model, the tax authorities can realize the service procedure management of the unified allocation and transference of receipt, secure sale and real-time tracking which are based on the data centralized management of receipt information.

The traditional receipts have more than 45 types, but the network receipts only have two types, which are special electric receipt and general electric receipt. The special electric receipt refers to the construction installation receipt and real estate receipt, the receipt used by other industries is the general electric receipt. The network receipt reduces the cost and time for the taxpayers to get the receipts. The usage of traditional receipts would require the paper receipts of trigeminy and quartet, in the meantime, the network receipt only requires one which saves the receipt’s production costs needed to be paid. The traditional receipt users need to check the receipts in the tax authorities every month. But the realization of network real-time connection, they can complete receiving and purchasing, distribution, drawn and query of the receipts.

The network receipt has more efficiency compared with the tax authorities’ management over receipt. The real-time data distribution of network receipt realizes the connection of “receipt manages tax” and “data manages tax”, let tax authorities able to conduct the receipt data’s analysis application of query, statistics and comparison. The online application system of receipt uses the receipt information collected from the tax payers have the high accuracy, authenticity and comprehensiveness, providing basic data supports for data-manage-tax. It has the feature of “online receipt, digital anti-fake, comprehensive monitoring and convenient query”.

Four advantages

Taxpayers can dramatically reduce the costs of receipt. The traditional receipts requires at least three papers but the network receipt mainly uses one paper, which reduce two third of the production costs.

Taxpayers can save the money of tax-control machine. In the past, each enterprise needs to buy one tax-control machine, each costs 2000 to 3000 Yuan, and the maintenance cost is 200 per year. These costs can be saved after the promotion of the system.

Taxpayers can have real-time check over the true or false of the receipt through making phone calls.

Taxpayers can participate in the receipt lottery in a easier way. The system will automatically draw the receipt data into the lottery system and require no manual work by the customers, which only require a telephone number.

1.1.2 System architecture

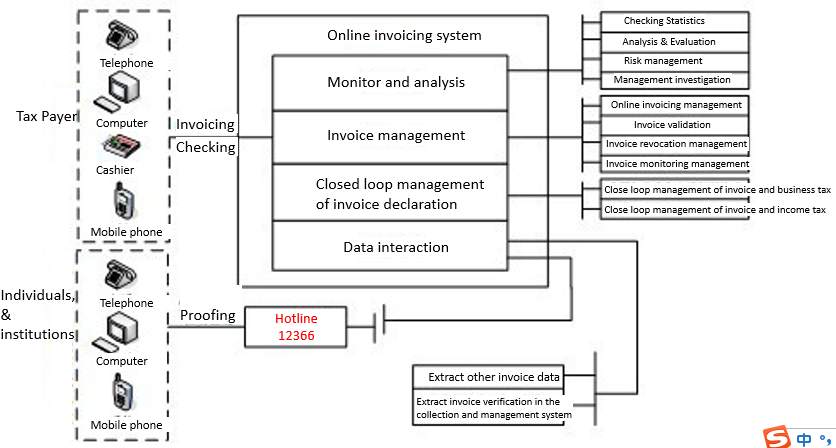

The main business functions of the network receipt system can be divided into some business function modules, which include receipt management, close-loop management for the declaration of the receipt, analysis of monitoring and exchanging of data. The function structure is shown below.

In which, the network receipt system for Jiangsu taxation bureau is as follows.

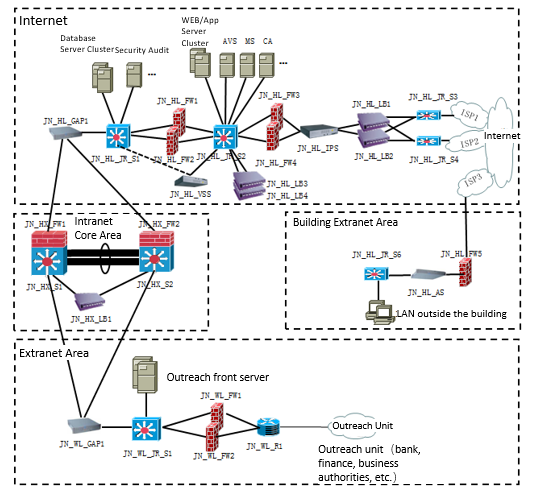

It is equipped with 1 set of DCstore high-end memories and 1 set of DS800 high-end memories, which are used for the backup of production data and failure recovery center’s data backup respectively. The four A840r-G server products purchased at April 2012 are used for the data’s processing and computing. The architecture is shown below.

1.1.3 Importance of project

The stable functioning of the system ensures the highly efficient storage and backup of online tax declaration data, network receipt data and cash register’s data of tax control.

Dawning Information Industry Co.,Ltd. Sugon Building, No.36 Zhongguancun Software Park, No.8 Dongbeiwang West Road, Haidian District, Beijing 100193

Tel:+86 400-810-0466

Fax:+86 10-56308222

E-mail:international@sugon.com

Dawning Information Industry Co.,Ltd. Sugon Building, No.36 Zhongguancun Software Park, No.8 Dongbeiwang West Road, Haidian District, Beijing 100193

Tel:+86 400-810-0466

Fax:+86 10-56308222

E-mail:international@sugon.com

Register /

Register /